Consumers, accustomed to personalisation through tech services like Amazon, Netflix and Spotify, want personalised guidance and support for savings and investments also, TISA research finds

- The FCA estimates that there are 8.4 million adults who have investable assets (of over £10k) but are not making use of the current types of formal support being made available to them, such as the financial guidance or advice services.

- New research from TISA and EY Seren sheds more light on why consumers are not making investment decisions, with 1) 32% of people finding it too complex and confusing; 28% of people not knowing enough about the options; 3) 24% of people not knowing where to start; and 4) 22% of people feeling overwhelmed by the number of product options available.

- According to the research, consumers want their financial services providers to make greater use of personalisation and better use of their data to help them make savings and investment decisions. The study showed that personalised support (even without a personal recommendation provided) would give consumers: 1) greater confidence in selecting relevant products; 2) greater reliability to make financial decisions; and 3) more motivation to select a product.

- However, present advice regulations limit firms’ ability to personalise their help and support to consumer, classifying such as advice and not guidance. TISA believes this needs to be addressed with urgency by Government and the FCA.

Personalisation has been a huge success in recent years, with companies such as Amazon, Netflix and Spotify growing at pace with the help of personalised algorithms. With consumers now accustomed to personalisation in everyday tech and media services, they are now demanding similar products from financial services providers.

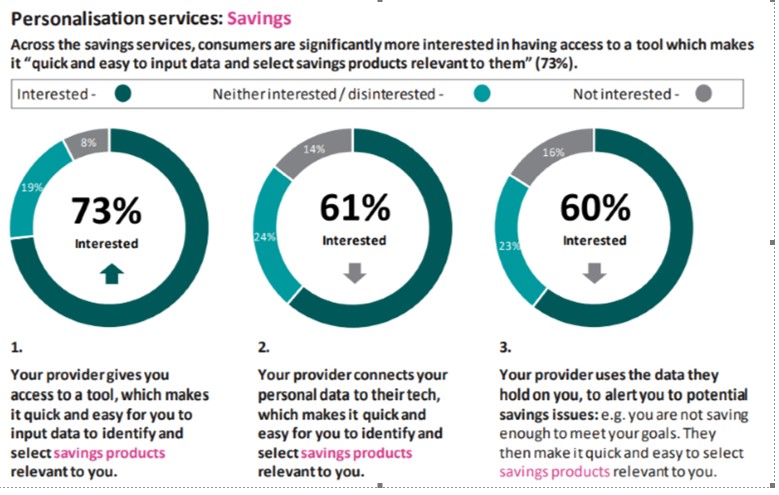

According to new research from EY Seren, commissioned by TISA, the cross-industry financial services membership body, 63% of people surveyed expressed interest in personalisation services to make savings and investment decisions, with 73% keen on “access to a savings tool which makes it easy to input data and select relevant savings products”. According to the research, younger savers significantly are more likely to want personalised support.

Only 4 million out of the 52 million adults in the UK have received financial advice in the last 12 months. High-quality, regulated financial advice is valuable but, for many, prohibitively expensive and many consumers do not consider it accessible. Personalised, simplified guidance and support should be available without the need to access advice.

Salesforce research in October 2020 found that customers expect personalisation in services, with 52% of clients expecting offers to always be personalised.1 The popularity of personalised services has ballooned, with retailers like Amazon, streaming services like Netflix and even holiday booking services like Booking.com developing complex algorithms to tailor suggestions to consumers.

The top perceived benefits of potential personalised, simplified financial guidance and support are “greater confidence in selecting the financial products relevant to me” (41%) and “greater confidence in making the right financial decisions” (39%), according to the EY and TISA study.

The need for proper preparation and guidance for retirement is growing in importance, as generation Defined Contribution will typically have less pension wealth and bear more risks than older savers with defined benefit pensions.

TISA is leading industry efforts to seek changes to the advice and guidance regulations to allow pension and investment firms to provide more engaging and personalised support services to consumers without it being as categorised as advice

The full research will be available on the 20th of September.

Relevant survey results here:

Prakash Chandramohan, strategic policy director at TISA said: “It is not surprising to learn from this research that consumers want their financial services providers to make greater use of personalisation and better use of their data to help them make savings and investment decisions. Choosing a tax wrapper and an investment product is arguably much more complex that choosing a movie to watch, yet financial services providers are the ones being curtailed in their ability to narrow down options for consumers and guide them to make a sensible investment choice.

Too many consumers are being left behind by sub-optimal financial decision making. Those with smaller savings pots are reluctant to pay the fees for quality, regulated financial advice. We are therefore seeking amendments to current regulation to allow personalised guidance and support to become more widely available and to level the playing field between investment firms versus other consumer industries.”

Katharine Photiou, Commercial Director – Workplace Savings at Legal & General at L&G, said: “Consumers are rightly demanding that the service they receive from their pension, investment and savings providers is modern, flexible and appropriate to their position. Retailers, streaming services and media have succeeded in adopting wide-spread personalisation in their products.

“There is no reason we cannot apply that approach to financial services. For the vast majority of consumers, a personalised guidance and support service would increase engagement, improve their outcomes at retirement and drive a change in attitudes towards pensions and savings. Nothing will replace full financial advice, but it is expensive for millions of smaller savers, who deserve quality support. We are supportive of amending regulations to allow personalised guidance to be delivered without categorising it as advice.

At Legal & General we know from experience that personalisation drives interest: we went with a personalised support model for our workplace pension interactive video statements, which improved engagement dramatically. We want to see consumers get even better services, through a new customer/ provider interface that will drive nothing less than a revolution in personalised financial services.”

An example of the L&G interactive workplace pension video consultation is here: https://demo.videosmart.com/landginteractivevbs/.